Conventional Rehab Loan

Introduction:

A rehab loan is a type of loan that investors and homeowners use to pay for the purchase and restoration of a home, frequently for personal use. Rehab loans are the best option because they combine acquisition and rehab financing into one loan, giving investors a quick and straightforward approach to funding a project.

What are Rehab Loans?

Rehab loans are residential property loans intended to assist consumers in purchasing and renovating a home. Homebuyers can utilize the loan to pay for the house’s acquisition and repairs, which enables them to meet their needs without incurring excessive costs.

Property investors can fund upgrades and renovations on existing residences with rehab loans. Traditional rehab loans offer one loan that can be used for purchases and promotions. For rehab financing, borrowers typically need credit ratings of 500 or above; however, individuals with scores of 620 or higher may qualify for a smaller down payment. Some lenders may impose extra rules, such as limits on the debt-to-income ratio or unique down payment requirements.

These are excellent options for homebuyers looking to transform an outdated property into their ideal home. Most rehab loans, including FHA 203(k) loans, require buyers to demonstrate that they will stay in the home being acquired and restored.

FHA 203(k) rehab loans

The most well-known federally funded residential renovation loan is the FHA 203(k). These loans, which fall under rehab loans, offer finance for purchasing and renovating a home. The Federal Housing Administration (FHA) provides loans open to all qualifying borrowers who satisfy eligibility standards.

These loans can be used to purchase and modify single-family homes, houses with up to four units, condos, townhomes, and mixed-use properties. To be eligible, borrowers must use the property as their principal residence.

For borrowers who need money to buy and renovate a house and want to take advantage of the low down payment choices provided by the FHA, FHA 203(k) Rehab Loans can be a great option. By avoiding the need for expensive repairs after closing, these loans help borrowers save money.

How Rehab Loans Work

Rehab loans can help real estate investors and individuals who want to turn a foreclosed property into their ideal house or a profitable business. These loans cover the materials and labor required to make the building safe and livable.

Refinancing an existing loan or bundling various repair costs into one payment are two more ways rehab loans can help clients save money. To accept a loan, borrowers must list the anticipated repairs and modifications.

Rehab loan process

The application procedure for a rehab loan is the same as for any other house loan. To be considered for a loan, applicants must fill out a standard loan application and submit financial information, documents, and details about the asset and project they wish to finance. After reviewing the application and inspecting the property, the lender decides whether the borrower is eligible.

Following approval, the borrower receives an initial loan amount following the terms of the loan program. This is the lesser estimated value upon rehabilitation or 110% of the current market value for FHA 203(k). This enables customers to buy or refinance the house and pay for repairs or improvements as part of their mortgage payment, all in one go.

Most rehab loans that are federally guaranteed also contain deadlines for when the work must be finished. All repairs must comply with particular HUD criteria and be started within 30 days of the loan closing and completed within six months. This is a requirement of the FHA 203(k) program. Any fees above the initial loan amount and any insurance and other closing costs related to buying or refinancing the home are the borrower’s responsibility.

Types of Rehab Loans

Rehab loans come in a variety of varieties. Some are federally guaranteed, like Home-style Renovation Mortgage and FHA 203(k). There are additional specialized loan programs from other lenders and complex money options available for those who need to meet the federally supported loan program requirements, need money sooner, or want to finance the renovation of a non-primary house. These programs differ depending on the lender, region, type of property, and other elements.

Listed below are a few alternatives for federally insured rehab loans:

Mortgage for Home-style Renovation

The federal government insures rehab loans through Fannie Mae through the Home-style Renovation Mortgage program. These loans allow borrowers to buy or refinance a home while getting the money they need for repairs and renovations. The ability to finance up to 50% of upgrades with a first mortgage is another benefit of these loans, as is the ability to finance 80% of improvements with combination mortgages.

Renovating Loan CHOICE

The renovation loan program for Freddie Mac is called CHOICE Renovation. With these loans, you can finance home upgrades and enhancements in the future with the ease of a regular mortgage. With this financing, borrowers can make any necessary modifications to a house while taking advantage of cheap fixed-rate alternatives, no origination fees, and no cash outlay at closing. For those who want to save time and money, it also makes it possible for homeowners to purchase a house and renovate it all at once.

Standard 203(k) loan

The Standard 203(k) loan is intended for more significant, more involved rehabilitation projects requiring structural modifications. For this financing, accurate repair cost estimates and the supervision of a HUD-approved consultant are requirements. Additionally, it permits borrowers to borrow up to 110% of the estimated value of their home following renovations, whichever is smaller. This makes it a tempting choice for borrowers wishing to buy or renovate a house requiring much work.

Streamline 203(k) loans

A simplified variant of the Standard 203(k) loan that does not need in-depth repair cost estimates is called a Streamline 203(k). The Borrower may finance up to $35,000 in repairs with this loan option but must complete all necessary repairs within six months of closing.

Standard 203(k) loans may not need a HUD consultant or additional paperwork; Streamline 203(k) loans do not. This can be appealing for debtors wishing to make minor changes without obtaining precise repair prices and dealing with other documentation.

What Are the Purposes of Rehab Loans?

Rehab loans tempt homeowners hoping to breathe new life into an old house. They make it possible to find the money for the supplies and labor required for remodeling or restoration work. Rehab loans can be used for various tasks, such as home expansions, landscaping, and changes to the kitchen and bathroom layout.

Many various kinds of properties can be updated, renovated, or improved with the help of rehab loans.

- detached homes for one family

- Apartments

- Townhomes

- Duplexes

- Fourplexes

- Triplexes

Limits on rehab loans:

Rehab loans with federal backing are intended for people who want to buy or refinance a house and make repairs or renovations as part of their mortgage payment all in one transaction. These loans are only permitted to be used on the Borrower’s principal residence, even though they provide borrowers with a lot of flexibility and financing alternatives and allow them to receive up to 110% of the estimated worth of their home after renovations or the current market value of the property.

However, there are several advantages for those borrowers who are eligible. By way of illustration, Streamline 203(k) customers can finance up to $35,000 in repairs without needing to obtain precise repair costs or deal with additional paperwork. With a rehab loan, borrowers can purchase or refinance a home and make the required modifications without paying upfront closing costs or other out-of-pocket expenses.

Rehab Loan Qualifications

Homeowners can finance any amount of repair project by securing a rehab loan. Your credit score and income are related to the fundamental prerequisites for a rehab loan. However, specific lenders could additionally have further requirements for borrowers to satisfy.

The standard requirements for applicants are a credit score of at least 500, consistent work or another solid source of income, sufficient savings for a down payment and closing fees, and a debt-to-income ratio of less than 43%. Additionally, the borrower must supply supporting evidence, such as pay stubs, W2s, most recent tax returns, and bank statements. The property the borrower plans to buy, the anticipated closing date, and other specifics of their transaction must all be disclosed by the borrower.

A HUD consultant must view and evaluate the property before closing on many rehab loans, in addition to the usual procedures for a conventional home loan, to ensure that all contractual obligations are completed. This entails validating that all repairs have been made as planned and adhering to HUD guidelines.

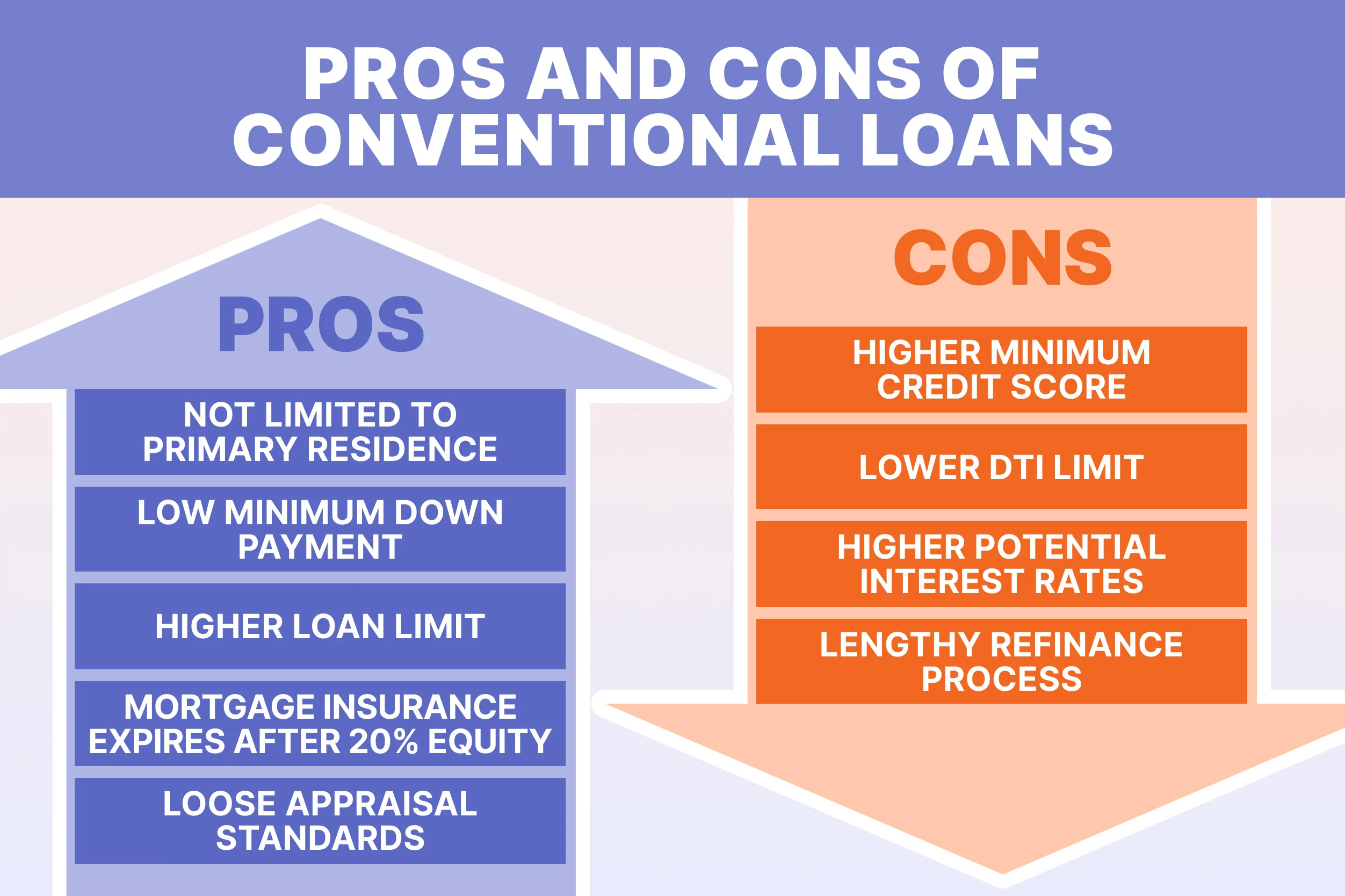

Pros and Cons of Rehab Loans

Pros

- Enables borrowers to buy and refinance a house and pay for improvements or Repairs as part of their mortgage payment in a single transaction.

- Finance up to 110 percent of the home’s estimated value following renovation, whichever is lower.

- Repairs up to $35,000 might be financed with minimal documentation.

- Some loans don’t need additional paperwork or comprehensive cost estimates.

- For borrowers, credit scores as low as 500 are acceptable.

- Investors can use a federal rehab loan to purchase up to four apartments.

- There may be alternatives for down payments of as little as 3.5%.

- Adaptable eligibility standards that enable persons who might not satisfy conventional loan requirements to qualify

Cons

- Options with little or no down payment require credit scores of 620 or higher.

- Some loans demand that a HUD-approved contractor or consultant supervise the work.

- Repairs must be finished within six months of the loan’s closing for most loan programs.

- The application procedure may take longer if there is more paperwork and documents.

- Debt-to-income ratios for borrowers must be lower than 43%

- A conventional mortgage may have higher interest rates.

- There is a maximum loan-to-value ratio of 110%.

Conventional Home Rehab Loans vs. FHA 203(k) Loans

When given two different loan options, it might be challenging for a prospective home buyer to understand the distinctions between conventional rehab loans and FHA 203(k) loans. Traditional rehab loans are frequently employed when a house undergoes more substantial renovations, which will cost more money than a regular remodel. Additionally, the money is disbursed according to a draw schedule as particular rehabilitation milestones are reached.

On the other hand, FHA 203(k) loans provide an all-in-one option that combines the cost of a home’s acquisition and any required repairs into a single lump sum. Unlike conventional loans, there are restrictions on how much money you can borrow via this scheme. It pays to conduct your research and determine which style best suits your scenario if you’re considering improving your property beyond modest upgrades.

Post Comment